The Foot Soldiers of Formal Banking in Rural India

Half a billion Indians have been able to open their no-frills Jan Dhan bank account for the first time in the last nine years thanks to Bank Mitras and Bank Sakhis who teamed up with village heads to achieve this feat.

Pratyaksh Srivastava 4 Oct 2023 12:45 PM GMT

Pratyaksh Srivastava 4 Oct 2023 12:45 PM GMT

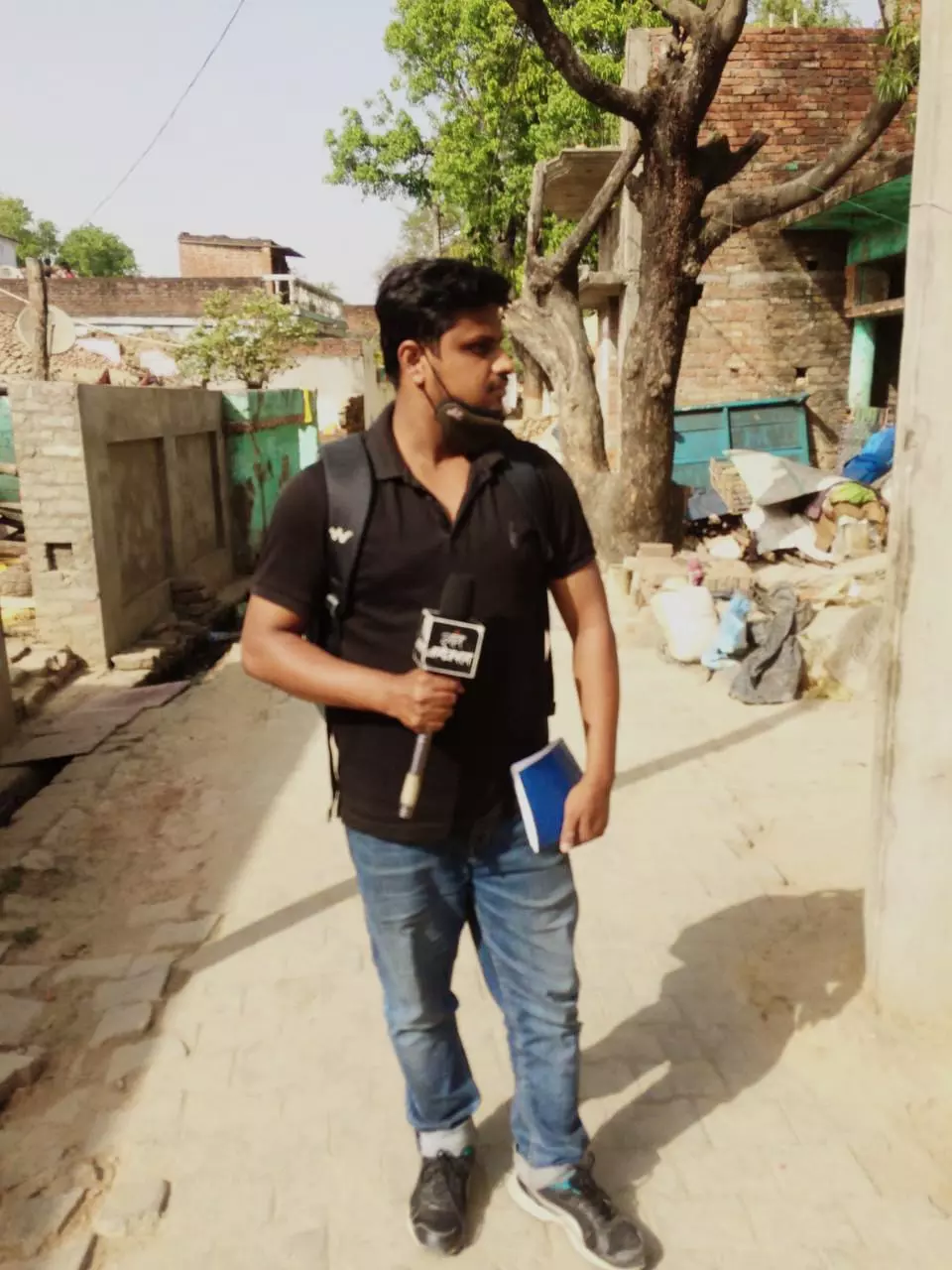

Experts mention that linking over 509 million people to formal banking in the past nine years has been incredible. Photo by Pratyaksh Srivastava

Over half a billion people in India have become a part of the formal banking system in the past nine years because of the central government’s no-frills bank accounts popularly known as Jan Dhan accounts.

Of the 509 million people who now hold the zero balance Jan Dhan account, almost 67 per cent are in rural and semi-urban areas.

This feat has been achieved due to an army of men and women, in their thousands, who have been visiting villages persuading people to open bank accounts as part of the Union government’s Pradhan Mantri Jan Dhan Yojana (PMJDY) launched in 2014.

These foot soldiers — Bank Mitras and Bank Sakhis — have been instrumental in getting over 330 million Jan Dhan accounts in the rural and semi-urban areas. They continued to function all through the pandemic, even when the catastrophic second wave of COVID 19 hit the country and left hundreds of thousand dead.

Also Read: Meet The ‘Savings Agents’ Who Help Strengthen India's Rural Economy

“We had to educate and raise awareness amongst the people about the benefits of having a Jan Dhan bank account,” Ritanshu Maurya, a 24-year-old Bank Mitra, told Gaon Connection. Maurya works at the Tikaitganj branch of Bank Of India in rural Lucknow, Uttar Pradesh. Bank Mitras like Maurya are not employed by the banks but work on commission basis, but are integral to the banking system and the financial inclusion programme of the Indian government.

On February 2, 2021, the Union Finance Minister mentioned in a statement in the Rajya Sabha that there are 958,586 such banking agents across India.

The pradhans have the trust of the villagers and are crucial in raising financial literacy in their people, said Sanjay Kumar Yadav, a bank mitra who works at the Tikait Ganj Bank in Lucknow.

“The finance ministry had set targets for banks to open a certain number of Jan Dhan accounts and without the Bank Mitras and Bank Sakhis, there was no way we could have achieved those targets,” Pawan Shukla, an assistant manager at the Bank of India in Tikaitganj, told Gaon Connection. According to him, the targets given by the government varied from 10,000 accounts in a month to 20,000 accounts in a month.

Similar thoughts were expressed by Sumit Kumar, general secretary of Bank Mitra Sangh in Muzaffarpur in Bihar. “The Bank Mitras worked even during the frightening pandemic times. They were frontline workers and their contribution has been immense. The record breaking opening of the bank accounts in the rural areas wouldn’t have been possible without these workers,” he said.

Also Read: Rural India: Consumption of Packaged Sugary Food On Rise, Access To Protein Declining — Study

Experts mention that linking over 509 million people to formal banking in the past nine years has been incredible.

“Such a quantum of financial inclusion has not been witnessed anywhere in the world before. Had it not been for these agents who work with the banks in the rural areas, this feat was impossible to achieve,” Sudarshan Maity, Kolkata-based deputy director of The Institute of Cost Accountants of India. He has authored several research papers on banking and financial inclusion.

When Bank Mitras teamed up with mukhiyas

For Bank Mitras and Bank Sakhis to reach the last person in the remote village, they took the help of mukhiya or pradhan (village head). The pradhans have the trust of the villagers and are crucial in raising financial literacy in their people, said Sanjay Kumar Yadav, a bank mitra who works at the Tikait Ganj Bank in Lucknow.

“The pradhans have immense influence in the villages. The people count on them for advice. Once we got the pradhans on our side, our campaign received credibility,” Sanjay Kumar told Gaon Connection.

Ranjeet Yadav is the pradhan of Mohammadpur village in Lucknow district. “Often villagers are not aware if the opening of an account will benefit them. They are also suspicious of getting duped. I told villagers that the scheme will make it easier for them to get government benefits,” said the pradhan, “and it worked”.

These foot soldiers — Bank Mitras and Bank Sakhis — have been instrumental in getting over 330 million Jan Dhan accounts in the rural and semi-urban areas.

About 1,000 kilometres southeast of the capital city of Uttar Pradesh, lies the forested and tribal dominant West Singhbhum district of Jharkhand. Tarique Anwar is a Bank Mitra in its Goilkera block. Between 2015 and 2018, he helped open 10,000 bank accounts, which, he said, could not have been done without the support of the village heads.

“I conducted meetings with mukhiyas (elected village head) in 2015, and campaigned in three panchayats — Kayda, Bila and Gamaria,” Anwar told Gaon Connection. He said how most of the villagers, about 35,000 of them, had never had a bank account before.

Also Read: Leisure, love, and work — The internet is empowering and revolutionising the lives of rural women

Bank Mitra like Anwar need to be at least 18 years of age and have passed class 10.

Benefits of Jan Dhan flow in

The Jan Dhan account can be opened with zero balance, and is extensively used by rural residents to avail financial benefits from government schemes such as Pradhan Mantri Kisan Samman Nidhi, Ujjwala Yojna, Indira Awas Yojana, DBT transfers, etc.

According to official records, the deposits in Jan Dhan accounts are above Rs. 2.03 lakh crore and about 34 crore RuPay cards have been issued in these accounts free of cost. The average balance in Jan Dhan accounts is Rs 4,076 and more than 5.5 crore such accounts are receiving DBT (direct benefit transfer) benefits.

Though the Jan Dhan Scheme has been a milestone in the financial sector, a lot more needs to be done.

“I received six thousand rupees in my khaata [Jan Dhan account] in three instalments for my pregnancy [Janani Suraksha Yojna]. The money is safe in my bank account. It will help my family survive should the crops fail, or if there is some emergency, ” Rambheji Kumari, who lives in Kalwari village in Sitapur district, Uttar Pradesh told Gaon Connection.

Aquila Begum, a 70-year-old resident of Tatraharting village in West Singhbhum district, Jharkhand, said opening her Jan Dhan account was helpful. “My widow’s pension and gas cylinder subsidies are paid into my account. I also got the money for a house under the Indira Awas Yojna deposited into my bank account.”

Nearly 1,000 kilometres away West Singhbhum, lives Kusuma Bansal, a 50-year-old Dalit villager from Umri village in Panna, Madhya Pradesh. “I can comfortably buy groceries now safe in the knowledge that my old age pension is deposited in my Jan Dhan account. I am not living hand to mouth anymore and able to manage my expenses better,” Bansal told Gaon Connection.

The Jan Dhan account has been of particular help to migrant workers and their families back home. “My sons who work in Mumbai are able to send money into my Jan Dhan account more easily now. Earlier they would give me money when they came home,” Reshma, a 45-year old rural resident from Kalvari village in Sitapur district told Gaon Connection.

Since the Jan Dhan account requires a zero balance, it has been a blessing for the poor. “I was glad when I heard about the zero balance facility in the Jan Dhan Yojana. Private banks ask for a minimum balance of at least Rs 1,000, failing to which the account is non-functioning,” Javed Ahmad, a labourer from Anantnag in Jammu and Kashmir, told Gaon Connection.

Not All’s Well

Sumit Kumar, the general secretary of the Bank Mitra Sangh in Bihar underlined that the Bank Mitras who have gone beyond the call of duty are not being provided what they were promised in 2014.

“The Union government had promised a fixed honorarium of Rs 5,000 per month to these agents but they have not received that amount ever. All they earn is the commission they earn for assisting in bank operations,” Kumar said.

Explaining the commission structure of bank mitras further, Kumar exemplified that for getting Rs 30,000 withdrawn or submitted in an account, their commission is merely Rs 18 which is also levied a Goods and Services Tax of 18 per cent.

“A bank mitra working in rural areas barely earns Rs 10,000 in a month on an average. With rising inflation and expenses on fuel and travel, the money they get paid doesn’t go well with the hard work they do,” he added.

Bank officials are also facing some hiccups.

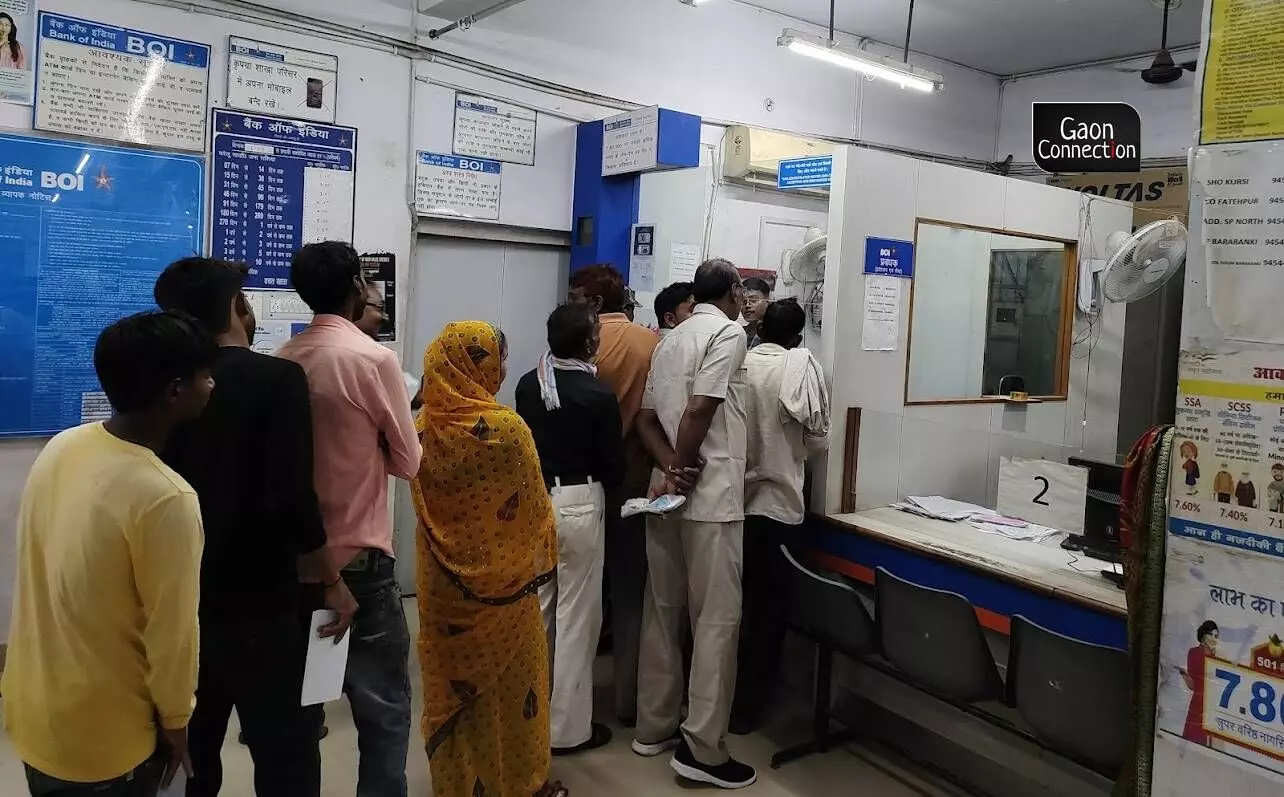

The Tikaitganj branch of Bank Of India in rural Lucknow, Uttar Pradesh.

“Out of the 40,000 savings bank accounts in my bank, 22,000 belong to Jan Dhan account holders,” Shukla, the assistant bank manager from the Tikaitganj branch in Lucknow pointed out. “The accounts doubled with the Jan Dhan initiative, but our workforce and resources have remained the same,” he added.

The rural bank branches hold the bulk of Jan Dhan accounts, which make it difficult for the bankers to focus on revenue generating activities. This has an impact on promotions that are linked to revenue generations, the assistant bank manager said. “Also, in banks like ours which are PSUs [Public Sector Undertaking], we have to meet the target of opening Jan Dhan accounts. This is not so in private banks that are not obliged to entertain schemes such as Jan Dhan,” he added.

Some beneficiaries complain that they are forced to maintain a balance in their Jan Dhan account. “Despite the fact that Jan Dhan Yojna requires no minimum balance, the banks ask us to maintain a balance of Rs 1,000,” complained Anoopa, a 50-year-old from Mohammadpur Garhi village, Lucknow.

Pawan Shukla, an assistant manager at the Bank of India in Tikaitganj.

However, Shukla, the assistant bank manager at Bank Of India, Tikaitganj branch, clarified: “The Jan Dhan account requires zero balance. But when villagers need to withdraw amounts above the stated limit of Rs 10,000 or deposit large sums of money, the Jan Dhan account has to be converted into a normal savings account. And it is these accounts that need to maintain a certain minimum balance. Many Jan Dhan account holders are unaware of this and confuse their savings account for Jan Dhan accounts.”

Though the Jan Dhan Scheme has been a milestone in the financial sector, a lot more needs to be done, said Maity of The Institute of Cost Accountants of India. The banks should have easy physical access in the rural areas, and they need an increase in staff and resources, he stated.

Bhikhe Khan, a 65-year-old farmer from Jaisalmer’s Gomat village in Rajasthan echoed his opinion.

“I have to go far to the Pokhran town to withdraw money from my Jan Dhan account. I get my pension from the government which is a thousand rupees. The town is ten kilometres away from my village, I would be glad if they make a bank in my own village,” Khan smiled.

With inputs Ramji Mishra in Sitapur, Sumit Yadav in Unnao, Manoj Chaudhary in Ranchi, Arun Singh in Panna, Mudasir Kuloo in Anantnag, and Kuldeep Chhangani in Jaisalmer.

#JanDhan Financial Inclusion Rural India

More Stories